Discovering the intricacies of your insurance policy after disaster strikes is far from ideal. Unfortunately, many people only learn about their coverage when they need to use it, and the surprises can be shocking. For instance, most standard water damage insurance does not cover flooding, even though floods are the most common form of natural disaster in America. Understanding the nuances of your insurance coverage is crucial to ensure you are adequately protected and prepared for any unforeseen events.

Water Damage vs. Flood Insurance: Water damage insurance covers any water-related damage to your home before it reaches the ground outside. This includes damage from a leaky roof or a broken pipe. However, if water seeps into your home from outside, it is generally not covered. Importantly, insurance covers the damage to your home, not the item or source that caused it. For example, if a broken pipe damages your carpet, the insurance will cover the carpet replacement but not the pipe repair.

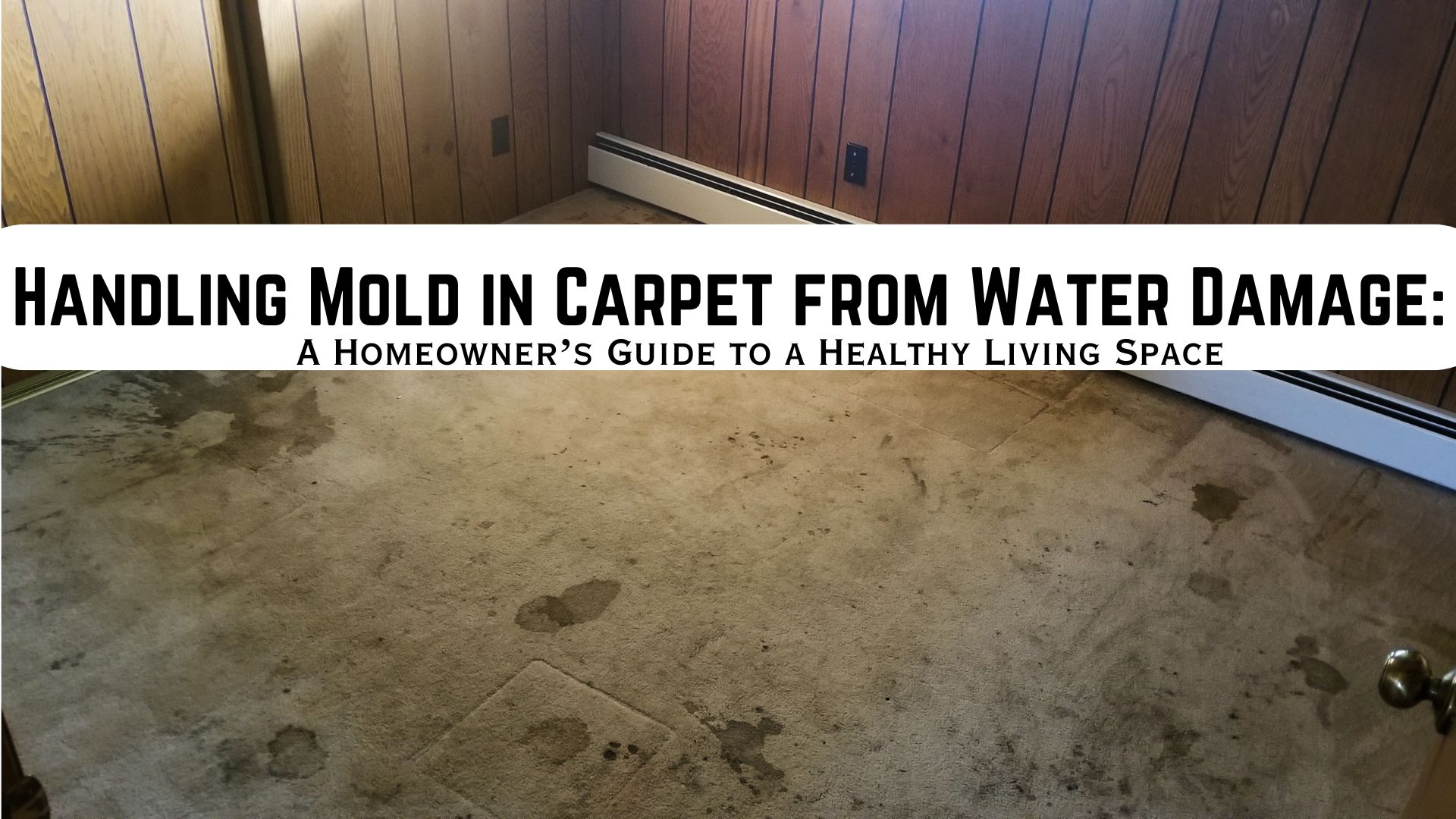

What Flood Insurance Generally Covers: Flood insurance is specifically designed to cover damages caused by flooding. This may include coverage for the building’s foundation, electrical and plumbing systems, firmly installed carpet, and paneling. Additionally, flood insurance may extend to removing debris and built-in appliances. For residents of California, understanding the specifics of flood insurance becomes even more critical, as homeowners have experienced challenges when seeking policy renewal after making claims. Some insurance companies cite high administrative costs and potential residual mold issues as reasons for denying renewal.

Be Informed, Be Prepared: Being well-informed about your insurance policy is key to preparedness for any eventuality. The last thing anyone wants is to face a disaster and discover that only partial coverage is provided. Take the time to thoroughly understand your insurance policy, its exclusions, and the additional coverage options available. Review your policy with your insurance provider, and ensure you have the appropriate coverage to protect your home and belongings from potential water-related damages.

Conclusion: Don’t wait for a crisis to learn about your insurance coverage. Knowing the differences between water damage and flood insurance can save you from unexpected financial burdens. Review your policy, understand its limitations, and consider supplemental flood insurance if necessary. Being informed and prepared will provide peace of mind, ensuring you are adequately protected when facing any unfortunate water-related events.